The Definitive Guide for Clark Wealth Partners

Clark Wealth Partners - Questions

Table of ContentsWhat Does Clark Wealth Partners Mean?The Clark Wealth Partners StatementsThe Basic Principles Of Clark Wealth Partners The Facts About Clark Wealth Partners Uncovered6 Simple Techniques For Clark Wealth PartnersNot known Facts About Clark Wealth PartnersThe 6-Minute Rule for Clark Wealth Partners6 Simple Techniques For Clark Wealth Partners

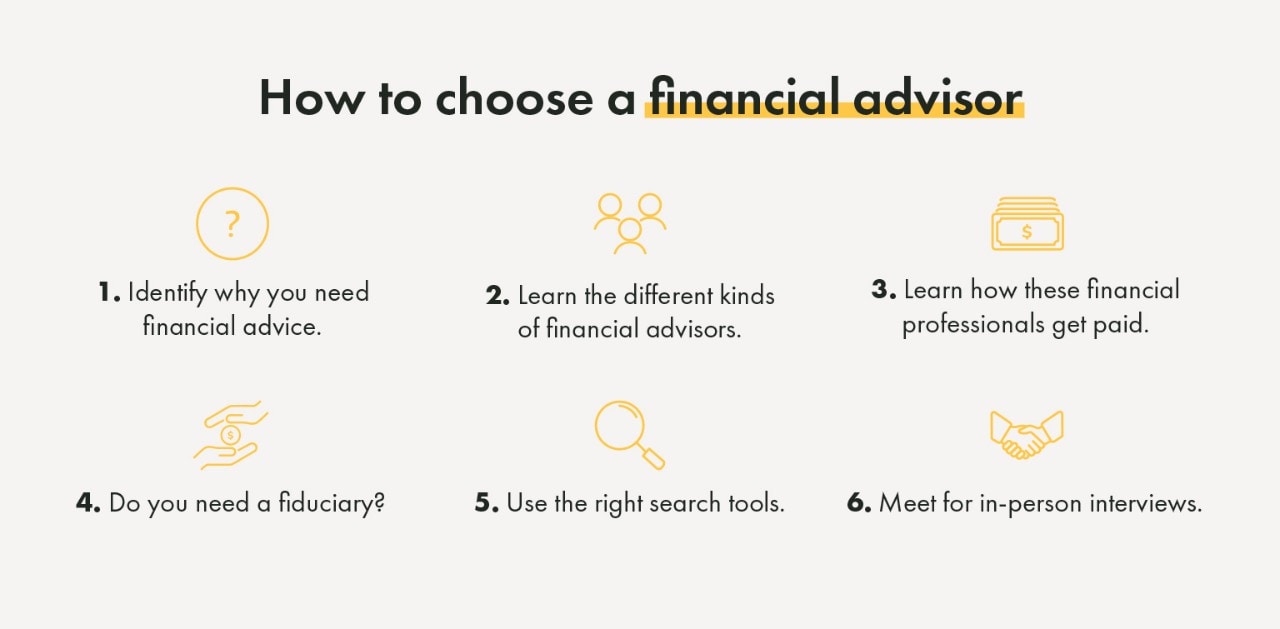

Usual factors to consider a financial advisor are: If your financial scenario has ended up being much more complicated, or you do not have self-confidence in your money-managing abilities. Conserving or navigating major life events like marital relationship, separation, children, inheritance, or task change that might dramatically affect your financial situation. Browsing the change from saving for retired life to maintaining wide range throughout retired life and how to produce a solid retirement income plan.New modern technology has brought about even more detailed automated economic tools, like robo-advisors. It depends on you to investigate and figure out the right fit - https://www.gaiaonline.com/profiles/clrkwlthprtnr/50611384/. Inevitably, a great financial advisor ought to be as conscious of your investments as they are with their own, preventing extreme costs, conserving money on taxes, and being as clear as possible about your gains and losses

The 5-Second Trick For Clark Wealth Partners

Gaining a compensation on item referrals does not necessarily suggest your fee-based expert works against your best interests. However they might be more inclined to suggest items and solutions on which they make a payment, which might or might not be in your benefit. A fiduciary is lawfully bound to put their customer's rate of interests.

This standard enables them to make referrals for investments and solutions as long as they fit their client's objectives, threat tolerance, and monetary situation. On the various other hand, fiduciary consultants are legally bound to act in their customer's finest interest rather than their own.

What Does Clark Wealth Partners Mean?

ExperienceTessa reported on all things spending deep-diving into complicated monetary subjects, dropping light on lesser-known investment methods, and uncovering ways readers can work the system to their advantage. As a personal finance specialist in her 20s, Tessa is really familiar with the effects time and uncertainty carry your investment decisions.

It was a targeted ad, and it functioned. Learn more Check out less.

Things about Clark Wealth Partners

There's no single course to coming to be one, with some people beginning in banking or insurance, while others start in audit. A four-year level offers a strong structure for jobs in financial investments, budgeting, and client services.

4 Easy Facts About Clark Wealth Partners Shown

Common examples consist of the FINRA Series 7 and Collection 65 tests for protections, or a state-issued insurance coverage license for marketing life or health insurance coverage. While credentials may not be lawfully required for all preparing roles, companies and clients usually see them as a benchmark of professionalism and trust. We check out optional credentials in the next area.

The majority of monetary coordinators have 1-3 years of experience and experience with economic items, compliance criteria, and straight client interaction. A strong academic background is essential, yet experience shows the ability to use concept in real-world settings. Some programs combine both, enabling you to complete coursework while earning monitored hours through teaching fellowships and practicums.

The Definitive Guide to Clark Wealth Partners

Early years can bring long hours, stress to develop a client base, and the need to continually prove your proficiency. Financial organizers take pleasure in the opportunity to work closely with customers, overview crucial life decisions, and commonly achieve flexibility in timetables or self-employment.

Wide range supervisors can enhance their revenues through payments, property charges, and efficiency perks. Economic managers manage a group of monetary organizers and advisors, establishing departmental strategy, taking care of compliance, budgeting, and guiding inner procedures. They spent much less time on the client-facing side of the industry. Almost all economic managers hold a bachelor's level, and several have an MBA or comparable academic degree.

More About Clark Wealth Partners

Optional qualifications, such check this as the CFP, generally require added coursework and testing, which can expand the timeline by a number of years. According to the Bureau of Labor Stats, individual financial advisors make a typical yearly yearly income of $102,140, with leading income earners making over $239,000.

In other provinces, there are guidelines that need them to satisfy particular needs to make use of the financial expert or economic coordinator titles. For financial planners, there are 3 common designations: Certified, Individual and Registered Financial Planner.

Little Known Facts About Clark Wealth Partners.

Where to locate a monetary advisor will depend on the type of advice you need. These institutions have team who may aid you recognize and get certain types of financial investments.